Will Gold Price Increase? A Comprehensive Investigation

The pressing question for investors and market analysts is: Will gold price increase more? To address this, we must examine the historical background of Gold. Gold has historically represented wealth, security, and stability. Its worth has endured over the centuries, establishing it as one of the most dependable assets during times of economic instability. The various factors that affect gold prices include economic conditions, investor behavior, and a few more. These can be discussed as follows:

1. Economic Uncertainty and Worldwide Disasters

Gold has consistently served as a safe haven during periods of financial distress. When economies encounter instability, such as recessions, inflation, or geopolitical conflicts, investors tend to gravitate toward gold as a dependable asset. This heightened demand typically results in price increases.

Case: The COVID-19 Catastrophe

During the COVID-19 crisis, gold prices reached unprecedented highs as investors sought protection from the volatility of the stock market and economic downturn, significantly boosting the demand for gold. If anybody asks that with the emergence of any new disaster, will gold price increase, then its answer is: yes.

2. Inflation

Gold is commonly perceived as a safeguard against inflation. As inflation rises, the purchasing power of traditional currencies declines, leading investors to seek gold to preserve their value. Gold maintains its intrinsic value throughout time. Unlike fiat currency, which can be produced without limit, the supply of gold is restricted. This limitation ensures its lasting value, even as inflation diminishes the worth of conventional money.

3. Central Bank Policies and Rate of Interest

Central banks significantly influence gold prices through their monetary policies, including interest rate changes and management of gold reserves. When interest rates are low, the cost of holding non-interest-bearing assets like gold diminishes. This situation makes gold a more appealing investment, boosting its demand, and the gold prices will increase.

Many central banks globally tend to acquire gold to diversify their reserves. Such purchases indicate a level of confidence in gold as a stable asset, positively affecting market prices, and the question of people, Will gold price increase in this case, then the answer is: yes.

4. Variations in the Value of Currencies

The price of gold is inversely related to the value of the US dollar, the currency in which it is usually denominated. When the dollar weakens, gold becomes less expensive for investors using other currencies, leading to increased demand and higher prices of gold. Conversely, a robust dollar can suppress gold’s value.

5. Gold Supply Constraints

Gold is a limited resource, and extracting new deposits is becoming increasingly difficult and costly. Mining companies encounter rising expenses due to deeper extraction methods, stricter environmental guidelines, and technological hurdles. These limitations on supply, combined with growing demand, will gold price increase.

6. Stockholder Thinking and Speculation

The prices of gold are influenced by investor psychology and prevailing market trends. During periods of fear, whether stemming from geopolitical issues or financial instability, investors generally flock to gold after knowing the positive response– Will gold price increase? Exchange-traded funds (ETFs) have simplified the process of investing in gold, leading to greater demand. Speculative trading within gold ETFs also plays a role in price fluctuations and upward movements.

Upcoming Forecasts: Will Gold Price Increase?

1. Short-Period Scenario

In the near term, gold prices are likely to respond to global economic situations and central bank decisions. Gold prices are forecasted to climb to $2,500/oz by the end of 2024. Further, it expects gold to rise to $2,623 in 2025.

Geopolitical Dangers

Persistent geopolitical conflicts, such as those arising from tensions or trade disagreements, could enhance gold prices. For example, escalating conflicts in Eastern Europe or Asia might increase investor interest in gold.

Financial Strikes

Indications of a decelerating global economy or concerns about a recession are expected to elevate gold prices, as investors look for safe assets.

2. Long-Period Scenario

The long-term outlook for gold prices is connected to fundamental transformations in the global economy, technological advancements, and shifts in consumer behavior.

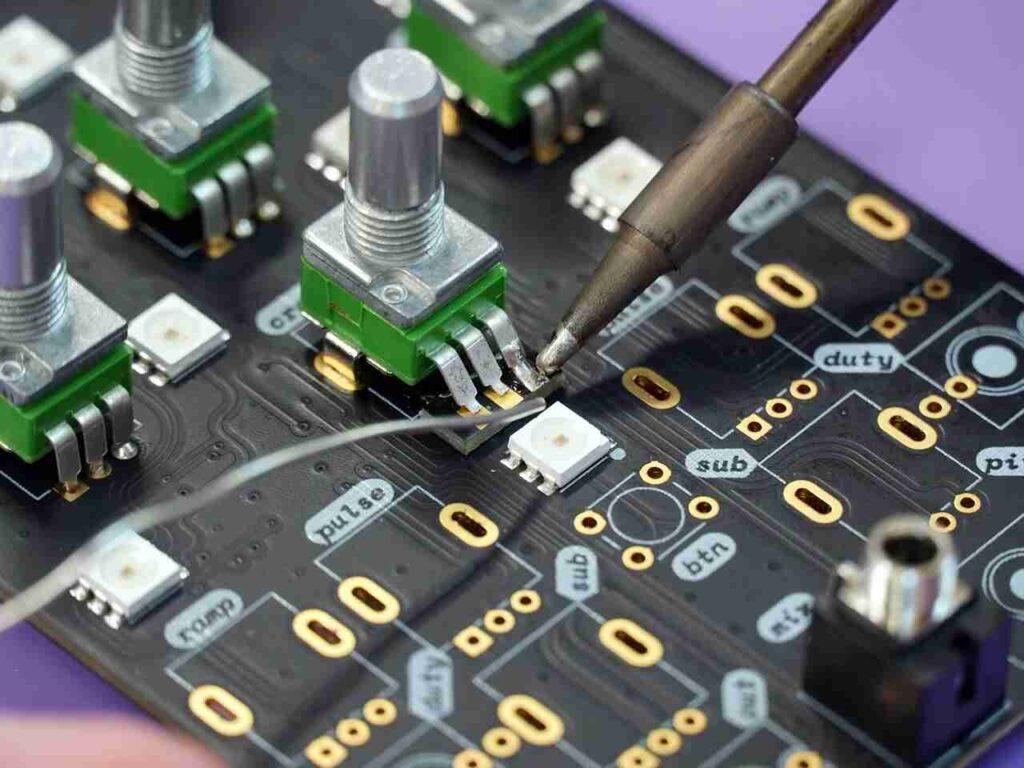

Scientific Demand

Gold’s significance in technology, particularly in electronics and renewable energy applications, is on the rise. This industrial demand may support increased prices over time.

Emergent Marketplace Demand

Nations like India and China are significant gold consumers, particularly for jewelry. As these economies expand, their gold consumption is likely to increase, potentially driving prices higher.

Must You Participate in Gold Here and Now?

As we have found the answer to this question, will gold price increase? So investing in gold is recommended as a wise strategy, according to my opinion, especially during uncertain times. Nonetheless, like any investment, it entails risks and considerations.

Benefits of Spending in Gold

After finding the yes answer to this question, “Will gold price increase? People like to invest in purchasing gold. So the following benefits can be achieved:

• Shield Against Inflation: Gold preserves purchasing power when inflation escalates.

• Portfolio Variation: Including gold can lower overall portfolio risk.

• Safe Haven: Gold tends to perform well amid economic and political unrest.

Dangers to Keep in Mind

• Unpredictability: Gold prices may experience considerable fluctuations in the short term.

• Lack of Continuous Income: Gold does not produce income like stocks or bonds.

Conclusion

The straight answer to the question: Will gold price increase? is that gold prices have a strong chance of rising next year. Gold prices are forecasted to climb to $2,500/oz by the end of 2024. Further, it expects gold to rise to $2,623 in 2025. The possibility of an increase in gold prices in the near and long term is bolstered by various factors, including economic instability, inflationary trends, and central bank policies.

Although predicting market fluctuations with certainty is impossible, the underlying fundamentals indicate that gold will remain a valuable asset for investors. If you are thinking about investing in gold, after knowing the yes answer to this issue—will the gold price increase?—it is essential to carefully assess your financial objectives, risk tolerance, and prevailing market conditions. Keep in mind that gold is not merely a commodity but also a reflection of global economic vitality and investor sentiment.